- #Set up a line of credit with a balance on quickbooks for mac how to#

- #Set up a line of credit with a balance on quickbooks for mac download#

(In the example below, the Accumulated Depreciation account doesn’t appear because we haven’t recorded any transactions to that account yet.) Figure 6Īre You a Small-Business Owner Paying Too Much Tax? Figure 5Īfter you’ve recorded the purchase, the fixed assets will show up on your balance sheet as of the purchase date (see Figure 6). See Figure 5 for an example.Īll you have to do next is enter a vendor and a memo like you would for any other check you write, and then click “Save & Close” (or “Save & New” if you have multiple checks to write, of course). Note that you can select more than one fixed asset item for the same purchase. Once you select the fixed asset item(s) you created for this purchase, QuickBooks will automatically enter the purchase amount into the check. Now scroll through your item list to find the fixed asset items we created during step one, above. Select an empty field under the column labelled “Item” and click the drop-down arrow. Next, select the “Ite ms” tab (about halfway through the screen). So start by going to Banking → Write Checks. Probably the easiest way to do this is through the Write Checks window.

#Set up a line of credit with a balance on quickbooks for mac how to#

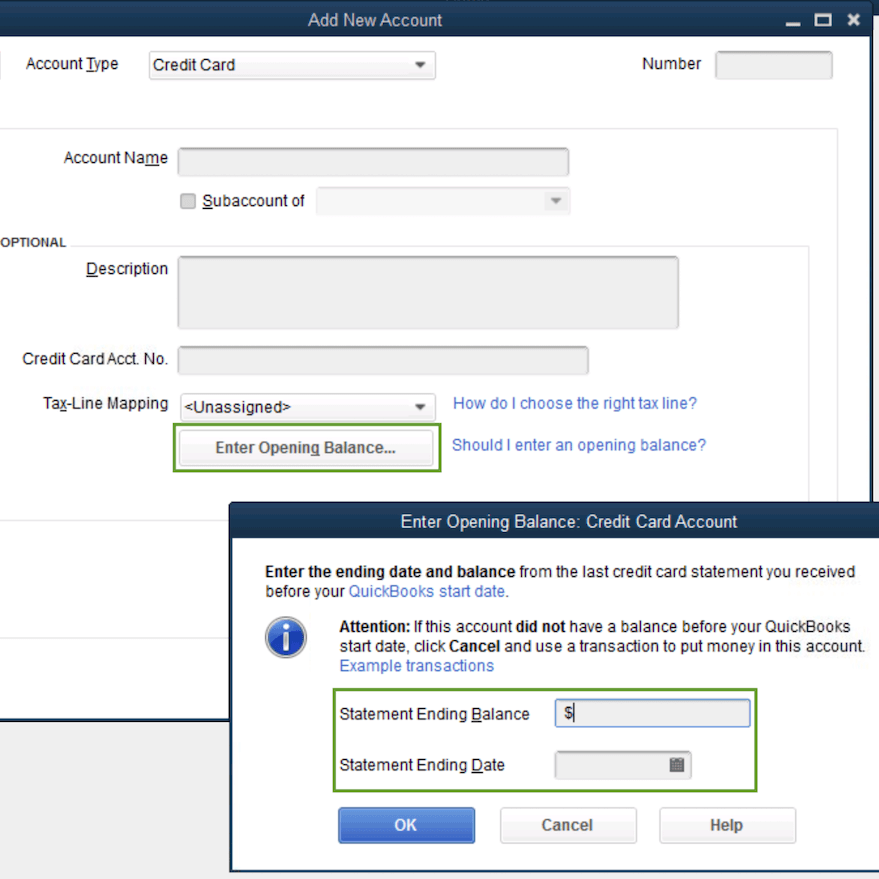

(I might name these subaccounts “Original Cost” and “Accumulated Depreciation”.)Ĭreating subaccounts works the same way as any other account, except once you reach the Add New Account dialog box, you’ll want to check the box “Subaccount of” and select the appropriate account from the drop-down menu (see Figure 3 and Figure 4) Figure 3 Figure 4 How to Record a Fixed Asset Purchase in QuickBooksĪfter you’ve created fixed asset items for your assets in QuickBooks, you’ll want to make sure you actually record the purchase in your books. One other thing to note: If you’re creating an asset account for a depreciable asset, you’ll actually want to create two subaccounts for your fixed asset accounts: one to track the original cost of your purchases, and one to track accumulated depreciation. Then click the blue “S ave & Close” button. Enter a name for the account (for example, if you’re creating an account to track all of your office furniture, you might call this account “Office Furniture”). You can add accounts to QuickBooks in a variety of ways, but to do this while you’re describing the fixed asset item, first select the field labelled “Asset Account.” Next, scroll to the top of the list of accounts and click “.” QuickBooks displays the Add New Account dialog box (see Figure 2). You might have to create a new asset account for the fixed asset item. Once you’re done entering information about your fixed asset item, click the blue “OK” button in the upper-right corner. The one exception might be location if your business operates in multiple states. Note that most of the information requested in the “Asset Information” section might be helpful to track, but isn’t necessary to enter (at least as far as your tax accountant is concerned). Be sure to provide the name of the asset, which account the asset belongs to, and all of the information requested in the “Purchase Information” section. Next, in the bottom left corner, click the “ Item” button, then click “ New.” This will open the New Fixed Asset Item dialog box which you can use to enter information about the asset you’ve acquired. QuickBooks displays the Fixed Asset Item List window (see Figure 1). To do this, go to Lists → Fixed Asset Item List. Your first step when recording a fixed asset should be to record the fixed asset item in QuickBooks. How to Track a Fixed Asset Item in QuickBooks You win in all sorts of little ways-such as by not losing track of items you’ve purchased and such as by seeing items you’ve discarded and so need to write off. But you don’t lose by having good details inside your QuickBooks file. Note that your tax accountant will actually do a lot of this work for you-and that’s the way you probably want to roll. One more point about fixed asset item lists: Good, accurate rich details on your fixed asset items also track a lot of useful information you’ll need to calculate tax depreciation properly. For example, if you’ve purchased (say) twenty pieces of furniture, you don’t want twenty different line items on your balance sheet-you want one line item labeled “furniture.” What’s more, if you get nicely organized in the way you track these items, you can group fixed asset items under broad account names so your balance sheet is clean and easy to read.

A list, a good accurate list, of fixed asset items documents the “nitty gritty details” of which assets you own, for example. Maintaining a QuickBooks fixed asset item list does a lot to keep your asset accounts organized.

#Set up a line of credit with a balance on quickbooks for mac download#

Setting Low Salaries for S Corporations.

0 kommentar(er)

0 kommentar(er)